How To Save The Naira From Collapse: Economist’s Advice To Nigerian Government

The Nigerian government has been urged to adopt a radical measure to halt the rapid depreciation of the Naira against the US dollar and other major currencies. The measure is to ensure that every litre of crude oil exported from Nigeria is paid for in foreign currency.

This was the advice given by Paul Alaje, the Chief Economist at SPM Professionals, during an interview with Channels Television on Thursday. He said that this would increase the foreign exchange (FX) inflows into the country and stabilize the Naira.

He said, “There are things that must be done. If we don’t do these things, it will be impossible to stop the free fall of the Naira. If you lift one litre of crude oil in Nigeria, all the receipts must be in foreign currency. This is a short time measure that will boost FX inflows into Nigeria.”

He also stressed the need for the government to be consistent and decisive in implementing its policy interventions to restore investors’ confidence, especially multinational firms.

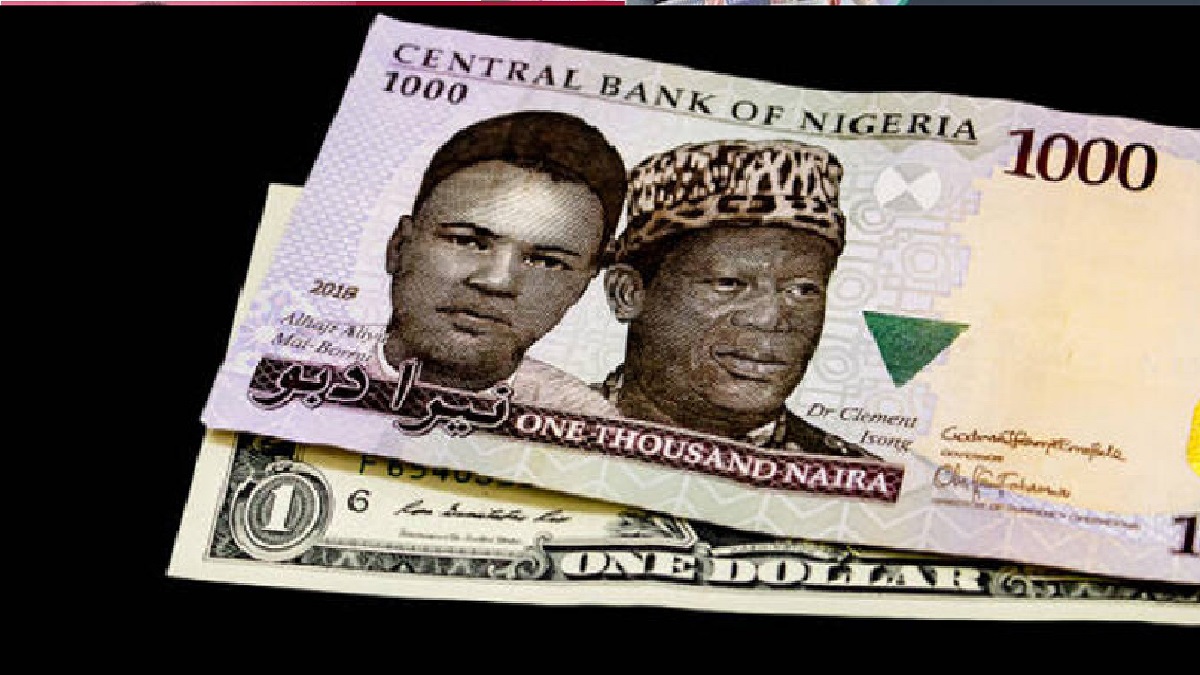

His advice came amid the Naira’s plunge to a record low of N1461.90 per dollar at the close of the FMDQ market on Thursday. The Naira has lost over 30 percent of its value since the beginning of the year, due to the dwindling oil revenues, rising inflation, insecurity and policy uncertainty.

The Central Bank of Nigeria (CBN) has tried to stem the tide by issuing various circulars and guidelines to regulate the FX market and curb speculative activities. For instance, the CBN recently removed the cap on exchange rates quoted by International Money Transfer Operators (IMTOs), allowing them to sell dollars at the prevailing market rates.

The CBN also issued a guideline on Wednesday to prevent foreign currency hoarding and manipulation by banks and other financial institutions. The guideline mandates them to sell all their foreign currency holdings within 24 hours of receiving them.

These interventions have had some positive effects on the Naira, as it recovered slightly against the dollar on Wednesday. However, the Naira remains under pressure, as the demand for dollars continues to outweigh the supply.

The economist said that the government needs to do more to address the structural issues affecting the economy, such as diversifying the revenue base, improving the business environment, enhancing security and boosting productivity. He said that these would create more value and reduce the dependence on oil and imports.