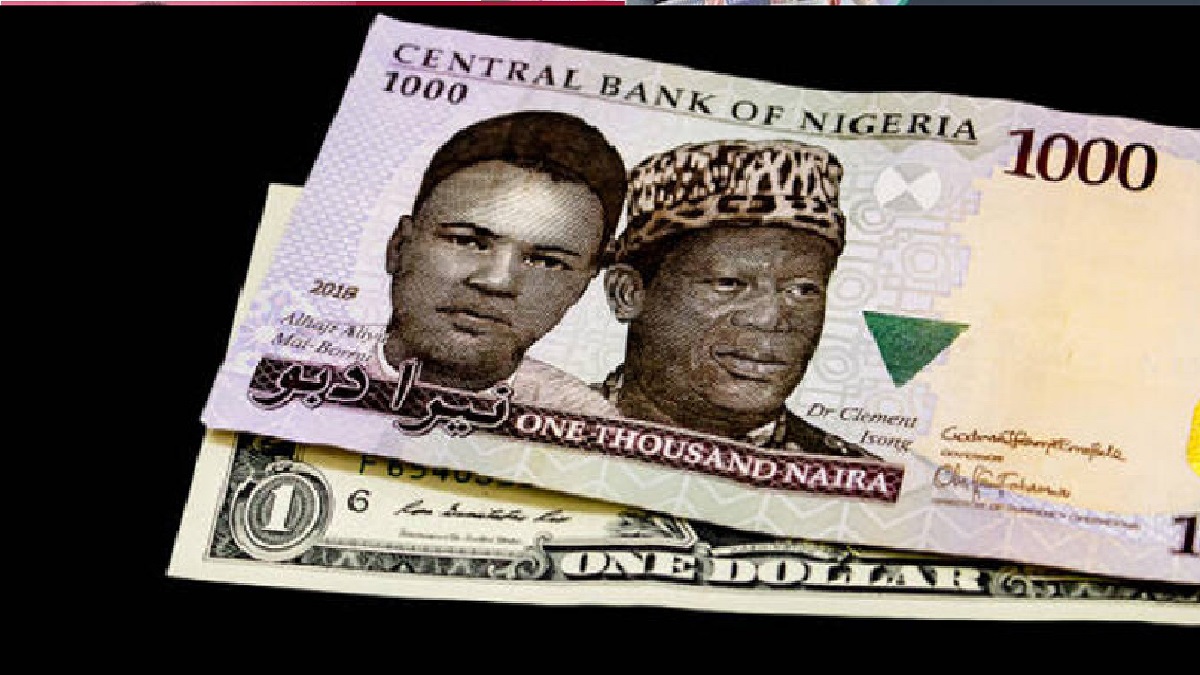

Inflationary Pressures and Naira Depreciation Propel Operating Costs of 10 Nigerian Banks to N3 Trillion in 2023

In the backdrop of escalating inflationary pressures and the devaluation of the Naira, the collective operational expenditures of ten prominent Nigerian commercial banks surged by a substantial 42.51 percent, reaching a staggering N3.23 trillion in 2023, compared to N2.26 trillion recorded in the preceding year. These revelations stem from the comprehensive annual financial reports submitted to the Nigerian Exchange Limited by these financial institutions.

The analyzed financial institutions encompass a spectrum of key players, including Access Holdings, FBN Holdings, Zenith Bank, United Bank for Africa, FCMB Group, Sterling Financial Holding, Fidelity Bank, Wema Bank, Stanbic IBTC, and Guaranty Trust Holding Company.

Within this period, Access Corporation witnessed a notable 38.85 percent escalation in its operational expenses, surging to N697.53 billion from N502.36 billion in 2022. Shedding light on this surge, Access Corp attributed the spike primarily to a 43.97 percent surge in personnel expenses, soaring to N167.90 billion from N116.62 billion, attributed to increased wage and salary outlays. Furthermore, other operational expenditures ascended to N465.67 billion from N341.32 billion, driven notably by mounting IT and e-business costs, which soared to N78.05 billion.

Additionally, the pronounced 30.49 percent upswing to N68.81 billion in the Asset Management Corporation of Nigeria surcharge borne by the group last year further contributed to the burgeoning of its operational outlays. Access Corp’s depreciation and amortization costs stood at N63.96 billion.

FBN Holdings’ unaudited findings divulged a striking 46.83 percent surge in operational expenses, amounting to N534.34 billion in 2023.

FCMB Group, per its unaudited report for 2023, observed a 35.64 percent ascent in operational expenses to N154.44 billion, predominantly propelled by inflated personnel expenses.

Sterling Financial Holdings Company and its subsidiaries, as per their condensed unaudited interim financial statements for 2023, witnessed a 25.26 percent rise in total expenditures, reaching N109.24 billion.

Fidelity Bank reported a substantial 60.77 percent surge in operational expenses to N194.18 billion from N120.78 billion in the preceding year.

Meanwhile, Wema Bank, which registered an impressive profit-before-tax growth of 196 percent to N43.59 billion in 2023, concurrently witnessed a 32.16 percent surge in operational expenses, amounting to N78.76 billion.

For Stanbic IBTC, operational expenses observed a 29.41 percent increase to N166.81 billion.

Likewise, the operational expenditures of Guarantee Trust Holding Company, GTCO, climbed by 26.54 percent to N250.42 billion, primarily attributable to burgeoning personnel expenses and other operational outflows.

Zenith Bank Plc, in its freshly unveiled annual report, unveiled a 32.31 percent surge in operational expenses, reaching N449.47 billion, while UBA’s operational expenses surged by a staggering 68.99 percent to N591.64 billion from N350.09 billion in the preceding year.

Concurrently, financial pundits have tethered the augmented operational expenses of these lenders to inflationary strains, Naira depreciation, and the escalating demands for salary revisions.

Nigeria’s headline inflation soared to a staggering 31.7 percent in February 2024.

Recalling that the Central Bank of Nigeria initiated the flotation of the Naira in June 2023 in a bid to fortify the country’s currency amidst challenging economic circumstances.