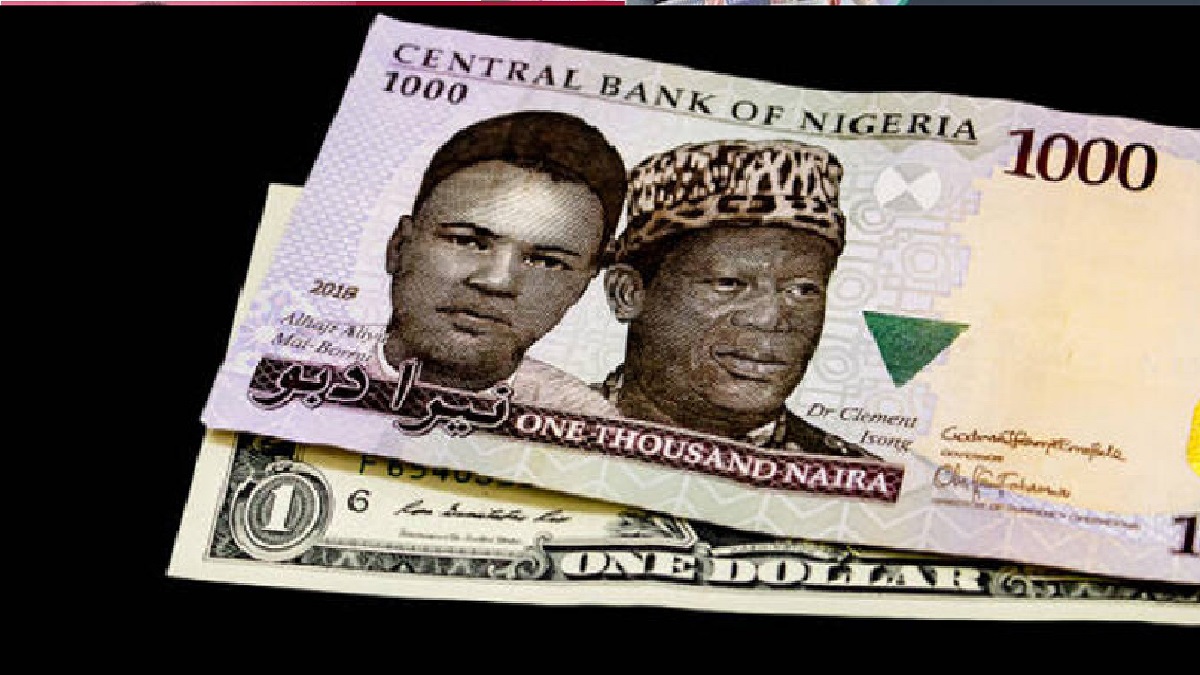

Naira Appreciates to N1,419 Per Dollar At Official Rate

The Nigerian currency, the Naira, has witnessed a remarkable appreciation against the US Dollar in the foreign exchange market, thanks to the Central Bank of Nigeria’s (CBN) recent policy reforms. The Naira gained 15.67 or 1.1% to close at N1,419.86 per Dollar on Monday, according to data from FMDQ. This is a significant improvement from N1,435.53 per Dollar recorded on Friday.

The Naira also performed well in the parallel market, where it traded at N1,410 per Dollar on Friday, up from N1,440 the previous week. This shows that the CBN’s interventions have had a positive impact on the Naira’s stability and liquidity.

The CBN, led by its Governor, Olayemi Cardoso, has introduced four policy reforms in the past seven days to address the challenges facing the Naira and the economy. These reforms include:

- A revision to the FMDQ FX Market Rate Pricing Methodology, which resulted in a more realistic and market-driven exchange rate for the Naira. The Naira depreciated from N891.90 per Dollar on January 26 to N1,410 on Monday, reflecting the true value of the currency.

- A guideline to curb foreign currency hoarding and speculation, which aimed to increase the supply of foreign exchange and discourage artificial scarcity and manipulation of the market.

- Fresh guidelines for International Money Transfer Operators (IMTOs) in Nigeria, which removed the cap on the exchange rate quoted by IMTOs and allowed them to offer competitive rates to customers.

- A circular to all authorized dealers and the general public, which clarified the modalities for the operation of the Naira 4 Dollar Scheme, which offers an incentive of N5 for every Dollar remitted through IMTOs and commercial banks.

These policy reforms are part of the CBN’s efforts to support the Naira and the economy amid the COVID-19 pandemic and the global oil price volatility. The CBN has assured the public that it will continue to monitor the situation and take appropriate measures to ensure the stability and growth of the Nigerian financial system.