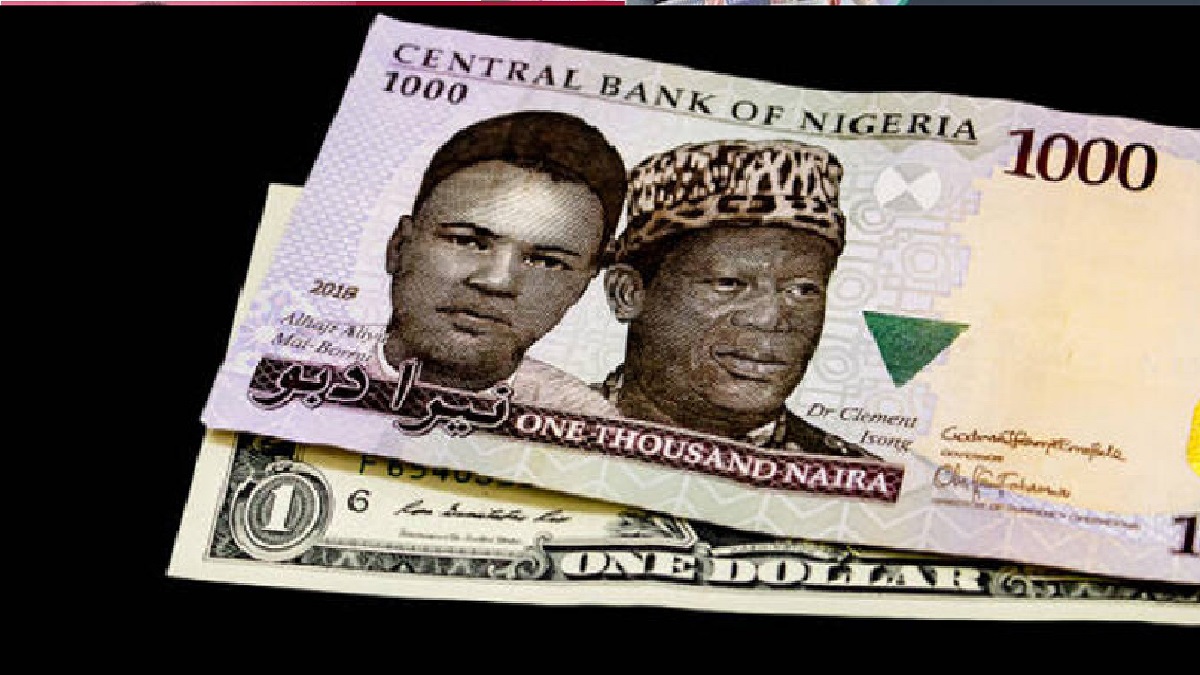

Naira Hits Record Low Against Dollar Despite CBN’s Forex Intervention

The Nigerian currency, the Naira, suffered a massive blow on Tuesday, losing 42 per cent of its value against the US dollar in the foreign exchange market within two days. According to FMDQ data, the Naira plunged to a historic low of N1,482.57 per US dollar on Tuesday, from N1,348.63 on Monday, marking a 9 per cent or 133.94 drop from the previous day’s closing rate.

The Naira’s free fall came after it breached the N1,000 per US dollar mark on Monday, January 29, 2024, as well as on December 8 and 28, 2023, when it traded at N1,348.63, N1,099.05 and N1,043.09 per dollar, respectively. The exchange rate also depreciated by 1.4 per cent, closing at N1,470 per US dollar on Tuesday.

This was the first time since the Naira was floated on June 14, 2023, that the official market exchange rate was higher than that of the parallel market by N12.57. The parallel market is where most Nigerians buy and sell foreign currencies.

The Naira’s depreciation occurred despite the Central Bank of Nigeria’s (CBN) efforts to inject liquidity into the forex market and clear the backlog of forex demand. On Tuesday, the CBN released an additional $64.6 million to clear the forex backlog of foreign airlines operating in Nigeria. Earlier, the CBN had announced that it injected about $2 billion to meet the forex needs of various sectors, including manufacturing, aviation, and petroleum.

However, these interventions seemed to have little impact on the Naira’s performance, as it continued to slide against the dollar in the forex market. Analysts have attributed the Naira’s woes to several factors, such as low oil prices, high inflation, weak economic growth, and dwindling foreign reserves.