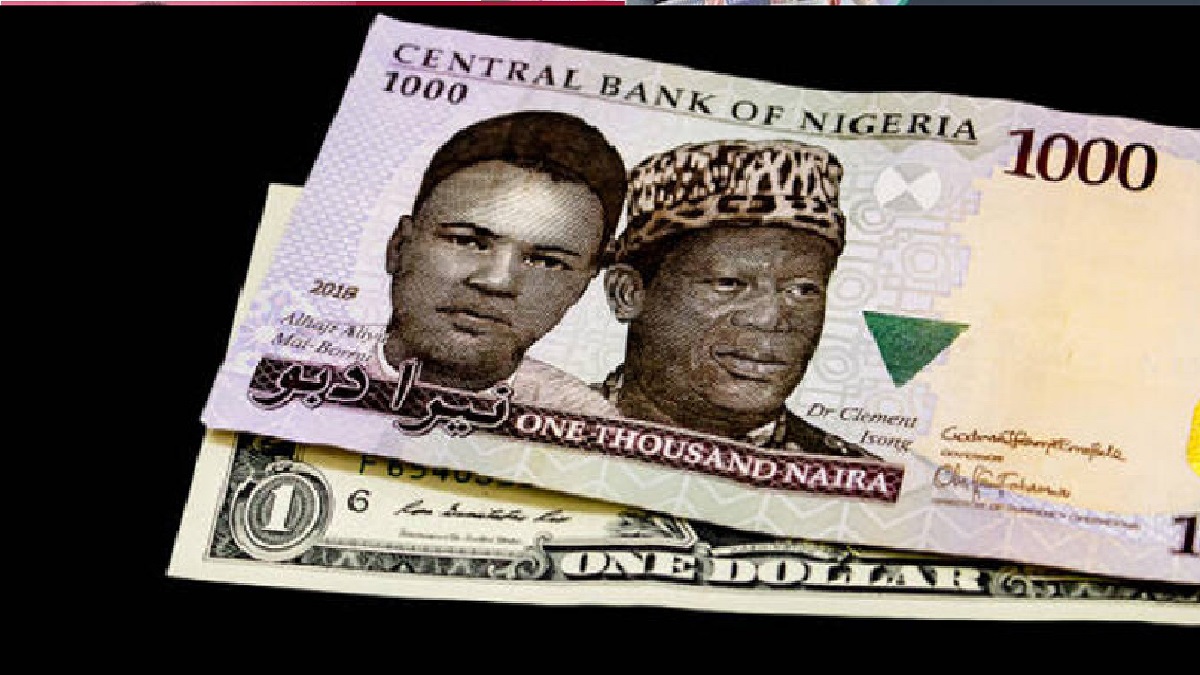

Naira Plummets to Record Low Against Dollar amid Foreign Exchange Crisis

The Nigerian currency, the naira, suffered a sharp decline against the US dollar on Friday at the official foreign exchange market. According to official data from the FMDQ, the naira lost N255.98 per dollar from N843.07/$1 on Thursday to N1099.05/$1 on Friday.

This was the first time since June 14, when the Central Bank of Nigeria (CBN) floated the naira that it exchanged at over 1,000 in the official market.

The development came despite the fact that the dollar supply increased by $137.35 on Friday from $135.58 million on Thursday.

The naira also depreciated at the parallel market, where it traded at N1180/$1 on Friday compared to N1170/$1 on Thursday. Dayyabu Mitstila, a Bureau de Change operator in Zone 4, Abuja, confirmed this to Newsflash Nigeria on Saturday.

“Friday, we sold US Dollar N1180/$1 and bought at N1170/$1”, he said.

Newsflash Nigeria reports that the CBN increased the exchange rate for cargo clearance from N783/toN952/ amid the foreign exchange crisis.

Recall that the Governor of CBN, Dr Olayemi Cardoso, speaking at the Chartered Institute of Bankers of Nigeria (CIBN) 50th-anniversary barely two weeks ago, expressed optimism over the stability of naira.

“I’m confident and optimistic that by taking appropriate corrective actions and strategic steps, we can restore macroeconomic stability and address fundamental flaws,” he stated.

Despite his assurance, the naira has continued to experience fluctuations in the FX market since June 14, when CBN floated the country’s currency.

The Nigerian currency crisis has been attributed to various factors, such as low oil prices, high inflation, weak economic growth, corruption scandals, and political uncertainty. The crisis has also sparked protests and violence across the country as people demand better governance and economic policies from their leaders.

Some analysts have suggested that a more flexible exchange rate system would help ease some of these pressures by allowing more market forces to determine supply and demand for foreign currency. However, others have argued that such a system would expose Nigerians to more volatility and uncertainty in their purchasing power and savings.