Naira Plummets to Record Low as CBN Releases $500 Million to Ease Forex Crunch

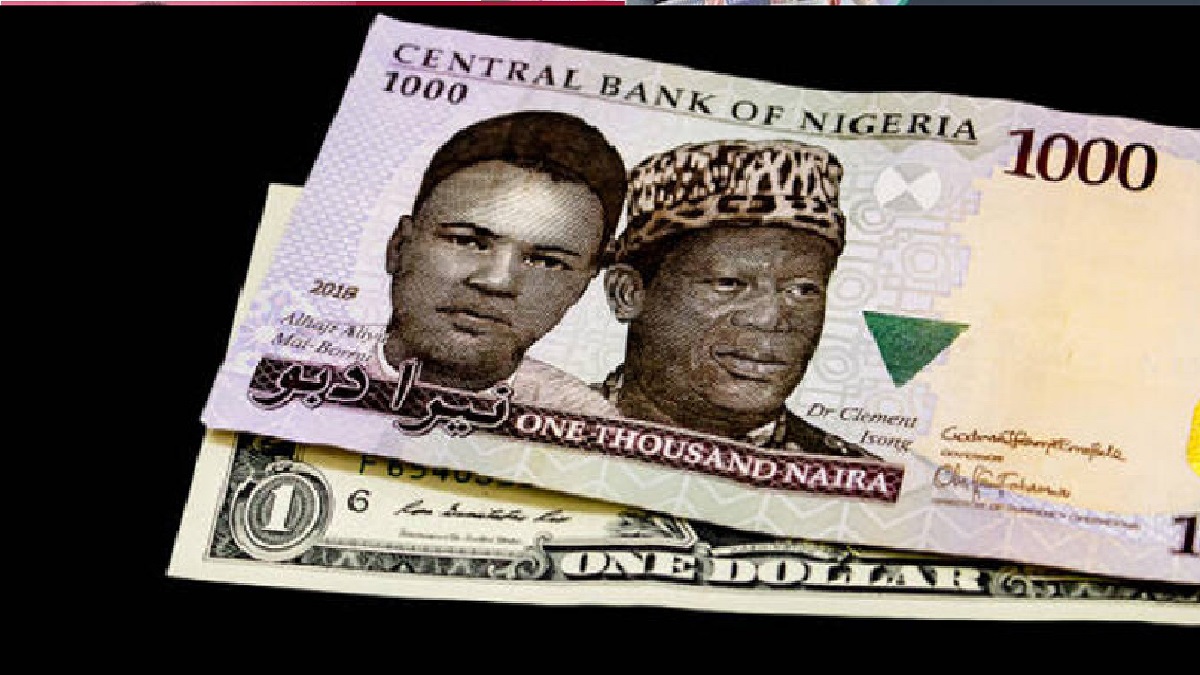

The Nigerian currency, the naira, suffered a massive depreciation of 24 per cent in the official Nigerian Foreign Exchange Market (NAFEM) on Monday, reaching a new low of N1,348 per dollar. This was the worst performance of the naira since June 2020, when the Central Bank of Nigeria (CBN) abolished multiple exchange rates in the official market.

According to data from FMDQ, the NAFEM rate dropped from N891.9 per dollar on Friday to N1348.63 per dollar on Monday, reflecting a loss of N456.73 or 24 per cent for the naira. The volume of dollars traded on NAFEM also declined by 28.5 per cent to $404.5 million last week, compared to $565.82 million the previous week.

The naira also weakened in the parallel market, where it fell to N1,425 per dollar from N1,400 per dollar over the weekend. As a result, the gap between the official and parallel market rates narrowed to N76.37 per dollar on Monday from N508.1 per dollar on Friday.

The sharp fall of the naira was attributed to the persistent dollar scarcity in the economy, which has been worsened by the impact of the COVID-19 pandemic and the decline in oil prices. The demand for dollars has outstripped the supply, putting pressure on the naira.

In an attempt to ease the forex crunch, the CBN announced on Monday that it had released $500 million to various sectors of the economy. This came barely a week after the apex bank disbursed about $2.0 billion to clear the backlog of foreign exchange obligations in the manufacturing, aviation, and petroleum sectors.

In a statement, the Acting Director of the Corporate Communications Department at the CBN, Mrs. Hakama Sidi Ali, said that the CBN was determined to settle all genuine foreign exchange backlogs within a short period. She also said that the CBN had embarked on a comprehensive strategy to improve liquidity in the Nigerian forex markets in the short, medium, and long term.

She quoted the Governor of the CBN, Mr. Olayemi Cardoso, as saying that the CBN’s focus was on addressing the fundamental issues that had hampered the efficient functioning of the Nigerian forex markets over the years. She added that the forex market reforms were aimed at streamlining and unifying multiple exchange rates, fostering transparency, and reducing arbitrage opportunities.

She expressed confidence that a stable exchange rate would enhance investor confidence and attract foreign investment to the country. She urged all market participants to abide by the rules, stressing that transparency in the market would ensure the fair determination of exchange rates and, consequently, guarantee stability for businesses and individuals.

She recalled that the CBN had released various amounts of dollars in the past few months in its effort to clear the backlog of foreign exchange liabilities.