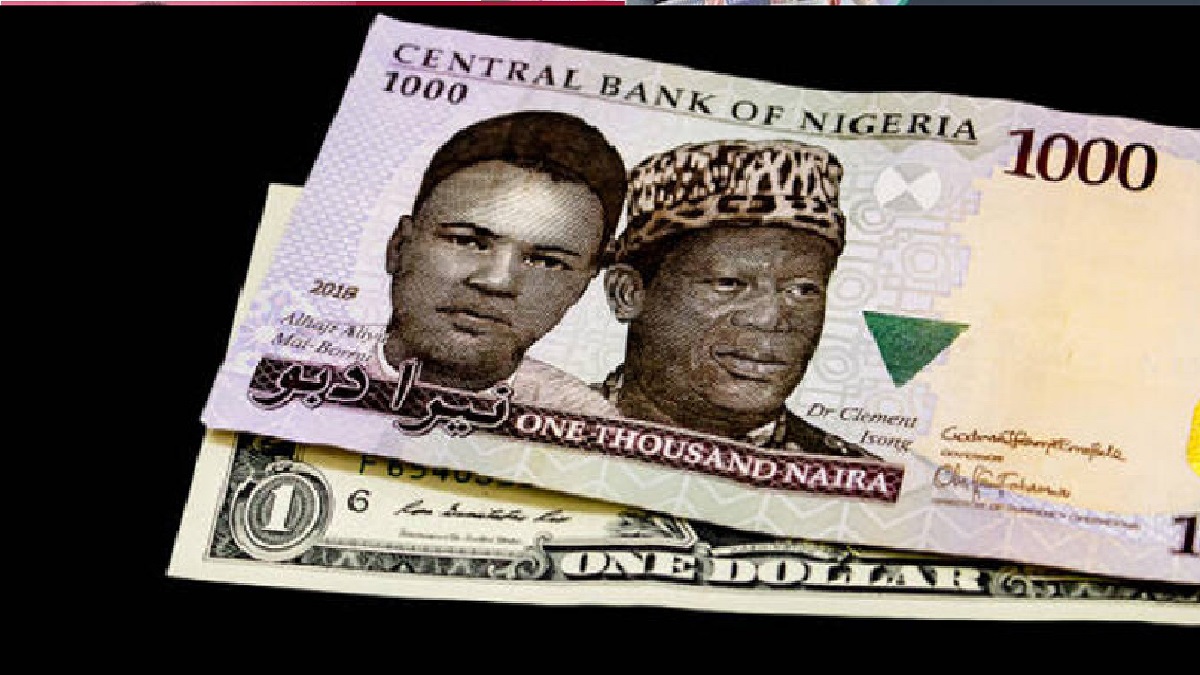

Naira plunges to N996.75/$ on I&E window amid forex scarcity

The Nigerian naira has continued to lose value against the US dollar in the foreign exchange market, reaching a new low on Thursday.

The naira closed trading on the Investor & Exporter forex window at N996.75/$, a 13.95 percent decline from the N874.71/$ it closed on Wednesday. Since the beginning of the week, the naira has depreciated by 27.75 per cent from N780.23/$1.

The naira’s decline is not limited to the official market. In the parallel market, where many Nigerians source for foreign currency, the naira has also fallen sharply.

According to Bureaux De Change operators, the naira traded at N1,140/on Thursday, a 20 per cent drop from N950/$ on Friday. Some traders said they would buy the dollar at N1,100/$ and sell it at N1,140/$.

The naira is one of the worst-performing African currencies in 2023, losing about 40 per cent of its value. The World Bank has attributed the naira’s weakness to the persistent shortage of foreign exchange and low oil prices on the economy.

The Central Bank of Nigeria has been trying to stabilize the naira by clearing some of its backlog of foreign exchange demand and injecting liquidity into the market.

However, these measures have not been enough to stop the naira’s slide. Some analysts have blamed speculators and hoarders for taking advantage of the situation and driving up the exchange rate1.

The presidency has expressed concern over the naira’s fall and promised to implement policies to strengthen the local currency.

A Special Adviser to the President on Economic Matters, Dr Tope Fasua, who represented the Vice President, Kashim Shettima, at an event, said: “For those who are speculating and praying and wishing that the currency would become nonsense, I believe that the central bank is rolling out the policies and the government that I serve, led by the President, will shock some of them.”

The naira’s exchange rate is a key indicator of the health of the Nigerian economy and affects the prices of goods and services, inflation, and interest rates.

The naira’s depreciation has eroded the purchasing power of many Nigerians and increased the cost of doing business. Many Nigerians are hoping that the government and the central bank will find a lasting solution to the naira’s woes and restore confidence in the economy.