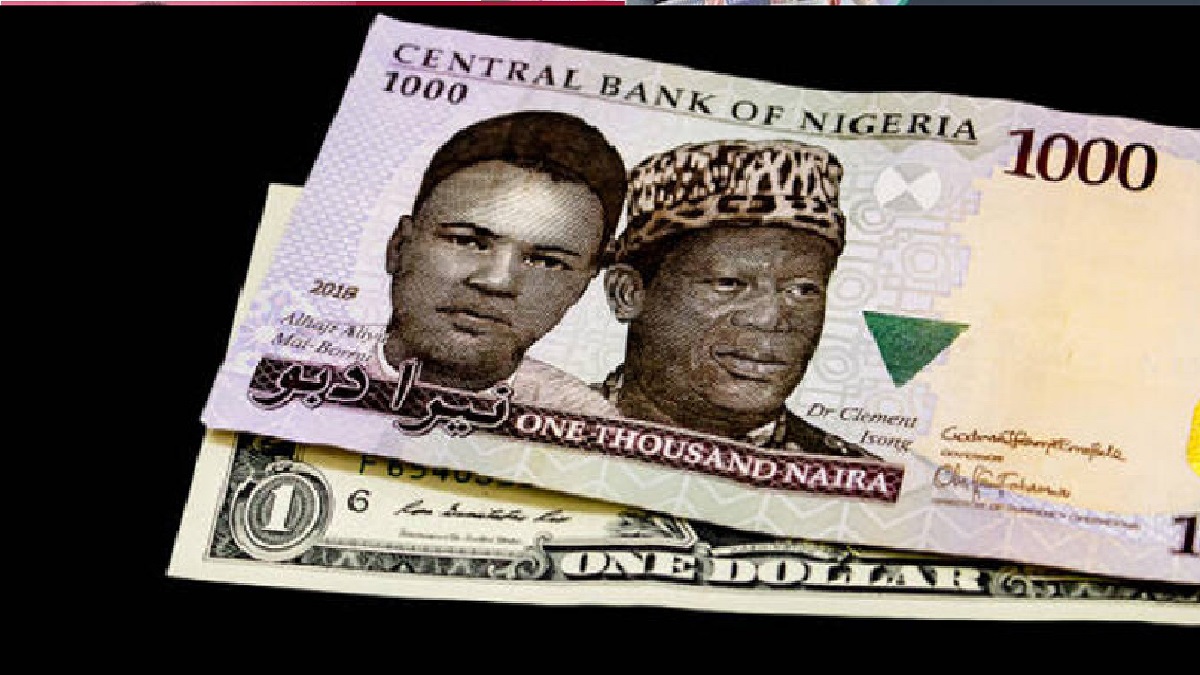

Naira’s Recent Tumble: Exchange Rate Hits 1,190/$ Against the US Dollar

In recent weeks, Nigeria’s currency, the Naira, has experienced a concerning decline, largely due to the growing scarcity of the US Dollar. This alarming trend has raised questions about the country’s economic stability and led to some noteworthy developments in the forex market.

Just a fortnight ago, the Naira was trading at 1,100/$ in the parallel market. However, last Friday, it opened at 1,175/$ and closed at 1,190/$, marking a substantial decrease in its value. While the Naira has weakened significantly in this market, there was a slight appreciation observed in the Investor & Exporter forex window, where it closed at 808.28/$ on Friday, compared to 810.05/$ the previous day, as reported by FMDQ.

This shift in the Naira’s exchange rate has created significant challenges for Bureau de Change Operators, who are struggling to provide forex to customers. According to Jubril Mutiu, a BDC operator, “On Friday, the price was 1,175/$, but we don’t even have it.

It is not available right now.

” Another operator, Adamu Afeez, mentioned their efforts to find individuals willing to sell to them, but admitted that they currently lack the necessary funds for purchases, stating, “Without the required currency, we are unable to engage in any selling transactions.”

The Naira’s volatility is evident as even within the same day, its value fluctuates. Ibrahim Abu, another BDC operator, commented, “We sold for 1,175/$ in the morning till afternoon on Friday. By 2 p.m., it was already selling for 1,190/$. It has been fluctuating. I don’t know what the rate will be on Monday.”

This ongoing devaluation of the Naira is a direct result of the Central Bank of Nigeria’s (CBN) decision to allow the exchange rate to flow freely, as initiated in June. Prior to this change, the Naira traded at 471.67/$ in the official market on FMDQ and 765/$ in the parallel market.

To address this unstable exchange rate, Dr. Aminu Gwadabe, President of the Association of Bureaux De Change Operators of Nigeria (ABCON), emphasizes the importance of fully involving the Bureau de Change (BDCs) in the retail segment of the forex exchange market. He highlights the need for collaboration among all stakeholders to achieve a stable and robust exchange rate in Nigeria. Gwadabe acknowledges the challenges facing the nation’s forex market and the depreciation of the Naira and asserts that BDCs should play a pivotal role in providing lasting solutions to the ongoing exchange rate volatility.

He emphasizes, “The continuous depreciation of the Naira in official and parallel markets does not benefit the BDCs and the domestic economy. Hence, steps should be taken to reverse the trend and strengthen the local currency for maximum economic impact.”

According to him, the CBN’s efforts to bridge exchange rate gaps demonstrate the regulator’s intentions to maintain stability, but involving BDCs is key to achieving a highly liquid market with stable rates.

Gwadabe also addresses concerns regarding market illiquidity, which affects the BDC sector. Additionally, he expresses dissatisfaction with unlicensed forex dealers engaging in speculative activities that tarnish the image of the sub-sector.

In conclusion, the decline of the Naira due to a scarcity of the US Dollar is a significant concern. Collaborative efforts involving BDCs, regulators, and other stakeholders are necessary to stabilize the exchange rate, ensure economic growth, and resolve the issues facing the forex market.