US Dollar Supply Skyrockets as Banks Fear CBN Sanction

The official foreign exchange market in Nigeria witnessed a huge influx of US dollars last Friday, as the supply soared by 180.59 per cent to $440.13 million. The reason behind this surge was the fear of commercial banks to face the regulatory sanction of the Central Bank of Nigeria (CBN).

The CBN had issued a circular last week, titled “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks”, in which it expressed concern over the increasing trend of banks holding large foreign currency positions. The circular stated that banks’ Net Open Position (NOP), which measures the difference between their foreign currency assets and liabilities, must not exceed 20 per cent short or 0 per cent long of the bank’s shareholders’ funds.

This means that banks must either reduce their foreign currency holdings or increase their shareholders’ funds to comply with the CBN’s directive. Failure to do so would attract severe penalties from the apex bank. Therefore, many banks rushed to sell their excess US dollars at the official market, leading to a spike in the supply.

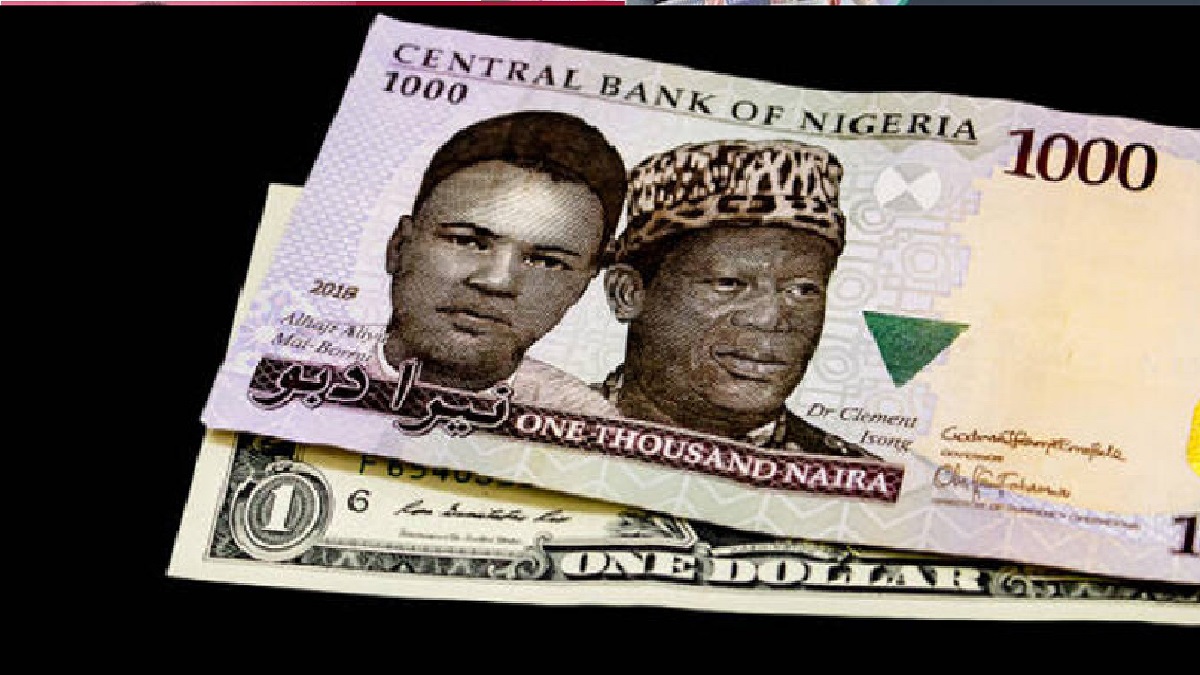

The increased supply of US dollars also had a positive impact on the value of the Naira, which appreciated slightly to close at N1,435.53 per US dollar at the official market on Friday, after a volatile week. The Naira also gained some ground at the parallel market, where it traded at 1,440 per US dollar on Friday, compared to 1,470 on Thursday last week.

According to data from FMDQ Security Exchange, which operates the official market, the total turnover of the market last week was $1.42 billion, up by 88.43 per cent from $754.11 million in the previous week.

The CBN’s move to harmonise the reporting requirements on foreign currency exposures of banks is part of its efforts to ensure transparency, stability and efficiency in the foreign exchange market. The CBN also intervenes regularly in the market to support the Naira and meet the demand for foreign exchange.